2024 China Industrial control equipment industry research and market research report

1. Application field

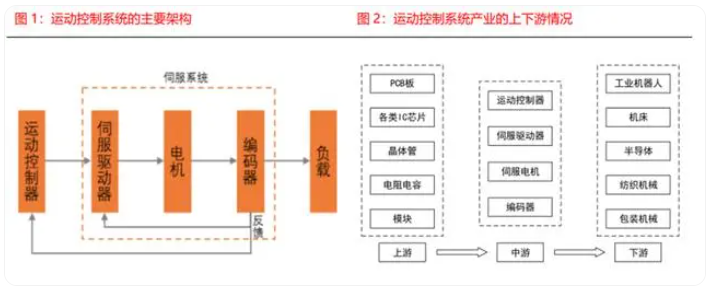

The motion control system is the brain of the device and is used to control mechanical equipment such as motors to achieve precise operations. The early motion control system mainly includes the numerical control system controlling numerical control machine tools. Now the motion control system has been widely used in equipment manufacturing, printing, packaging, textile, semiconductor manufacturing and industrial robots and other industries.

Motion control system is generally composed of controller, driver, motor, sensor and load. After the controller gives the command, the driver converts it into a current signal to drive the motor to rotate and drive the equipment to run. At the same time, the sensor on the motor feedbacks the real-time working condition of the motor to the controller, and the controller makes real-time adjustment to ensure the stable operation of the system.

2. Second, market status

(1)control layer: in 2023, large PLC performance is better than small PLCThe controller is mainly divided into: PC-Based motion controller (PC-based controller), dedicated controller and PLC (programmable logic controller). Among them, PLC has the advantages of small size, low energy consumption and strong anti-interference ability, and is widely used in the field of industrial automation.

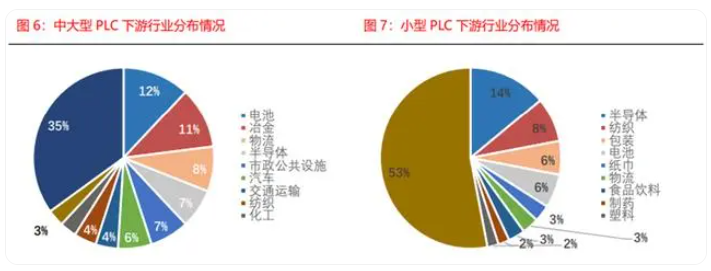

PLC can be divided into large and medium-sized PLC and small PLC. Market research data show that the overall prosperity of the PLC market in 2023 is not good, and the market size is about 16 billion yuan, down about 5%. Among them, large and medium-sized PLC is mainly used in the project market, supported by the project market capital expenditure, the market grew by about 1.1% in 2023, maintaining positive growth.

Small PLC is mainly used in the OEM market, affected by the poor climate of 3C, semiconductor and other industries and the slowdown of capital expenditure in the new energy industry, the market fell by 12.3% in 2023, which is a significant decline.

According to the industry research report, the downstream application industries of medium and large PLC include power, metallurgy, logistics, semiconductors and municipal public facilities, etc., and the downstream distribution of the project-based market is basically consistent.

2023 power, automotive, mining, chemical and municipal public facilities industry demand to maintain good growth, driving the growth of medium and large PLC market. The downstream application industries of small PLCS include semiconductors, textiles, packaging and batteries, etc., and the downstream distribution of the OEM market is more consistent. 2023 only wind power, photovoltaic equipment and semiconductor equipment and other industries demand to maintain positive growth, the rest of the industry boom is not good, resulting in 2023 small PLC market has a large decline.

(2) drive layer: servo market domestic products have occupied a large market share

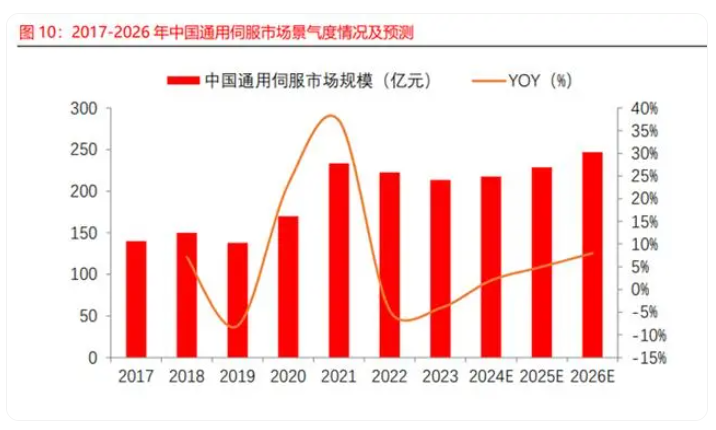

Market research data show that the size of China’s general servo market in 2023 is about 21.3 billion yuan, down 4.1% from 2022. Affected by the poor overall prosperity of the industrial control industry in 2023, the size of the general servo market has declined. Looking forward to 2024, the prosperity of consumer electronics, batteries, semiconductors and industrial robots and other industries has gradually recovered, and the domestic general servo market is expected to return to positive growth.

3. policy environment

On March 6, 2024, The State Council issued a policy of encouragement for the renewal of domestic equipment. The policy proposes to promote the upgrading and technological transformation of various production equipment and service equipment, encourage the replacement of traditional consumer goods such as automobiles and household appliances with new ones, and promote the replacement of durable consumer goods with old ones. The above policies are expected to boost the industrial control industry in 2024, driving the demand for project-based markets such as chemical, metallurgy, electric power and municipal public facilities and OEM markets such as machine tools, food and beverage equipment and automobiles.